Navigating the realm of Non-profit Financial Statements is pivotal for anyone involved in the non-profit sector, from board members and managers to donors and volunteers. These documents, including the balance sheet, income statement, and cash flow statement, are essential tools for assessing the financial health and operational efficiency of non-profit organizations. This article aims to demystify these financial statements, guiding you through their nuances to enhance transparency, accountability, and financial decision-making.

Understanding Non-profit Financial Statements: The Balance Sheet

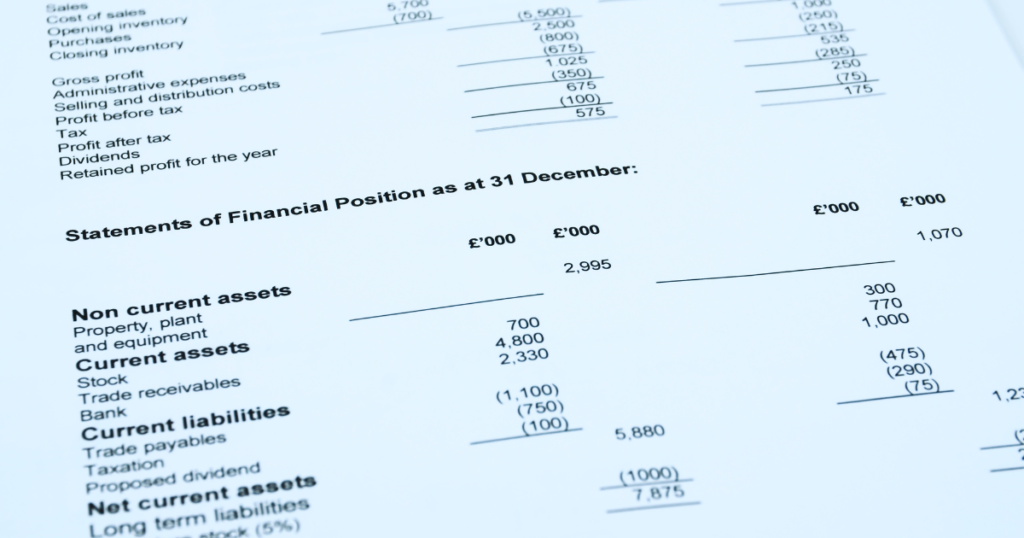

The balance sheet is a snapshot of a non-profit’s financial status at a specific point in time. It lists assets, liabilities, and net assets (or fund balances), providing a glimpse into what the organization owns versus what it owes. Key components include:

- Assets: Resources controlled by the organization, such as cash, investments, property, and receivables.

- Liabilities: Obligations the organization must meet, including payables, loans, and other debts.

- Net Assets: The difference between assets and liabilities, indicating the financial health of the non-profit.

For stakeholders, the balance sheet reveals the liquidity and sustainability of the organization, showing how well it can meet its short-term and long-term obligations.

Non-profit Financial Statements: The Income Statement

Also known as the statement of activities, the income statement displays the organization’s revenue and expenses over a certain period. This statement is crucial for understanding how the non-profit generates and spends money, categorized into:

- Revenues: These can come from donations, grants, services provided, and other income sources.

- Expenses: Costs incurred by the organization, such as program services, administrative costs, and fundraising expenses.

Analyzing the income statement helps stakeholders evaluate the non-profit’s operational efficiency and its reliance on various funding sources.

Delving into the Cash Flow Statement in Non-profit Financial Statements

The cash flow statement provides insight into the inflow and outflow of cash within the organization, highlighting how it manages its liquidity. It covers three main areas:

- Operating Activities: Cash generated or spent on the organization’s primary mission.

- Investing Activities: Purchases or sales of assets, such as property or investments.

- Financing Activities: Cash received from or paid to financing sources, including donations, grants, and debt.

This statement is vital for understanding the organization’s ability to maintain cash reserves and sustain operations over time.

Best Practices for Navigating Non-profit Financial Statements

To effectively navigate and utilize non-profit financial statements, consider the following best practices:

- Regular Review: Stakeholders should regularly review these documents to stay informed about the organization’s financial status and trends.

- Understand the Context: Financial figures should be analyzed in the context of the organization’s mission, strategies, and external environment.

- Use Comparative Analysis: Comparing current financial statements with past periods or budgets can reveal important trends and deviations.

- Seek Clarification: Don’t hesitate to ask for explanations about specific items or figures that are unclear. Transparency is key to trust and accountability.

Conclusion: The Importance of Non-profit Financial Statements

Non-profit Financial Statements are more than just numbers on a page; they are a reflection of the organization’s commitment to its mission, efficiency, and financial health. By understanding the balance sheet, income statement, and cash flow statement, stakeholders can make informed decisions, contributing to the sustainability and success of non-profits.

Navigating these financial statements requires diligence, but it’s a rewarding process that enhances transparency, accountability, and strategic planning. As the non-profit sector continues to evolve, so too will the importance of adeptly managing and interpreting these essential financial documents.

No responses yet